The IRS Just Released a More Compact Form 1040

- By Rick Sawyer

- •

- 14 Dec, 2018

- •

And the instructions fill 117 pages.

With the goal of simplifying Form 1040 to fit onto a postcard, the IRS just released the product of their efforts including the six new schedules for the 2018 tax year. Although shorter than previous 1040s, the new form doesn’t fit on a postcard and many taxpayers might not find it any easier than the 1040s of prior years.

(NOTE: The new 1040 and schedules can be found on the IRS website — https://www.irs.gov/forms-pubs/about-form-1040)

Among the notable changes —

No 1040EZ in 2018

Form 1040EZ was first introduced in 1982 as a simplified 1040 for single and joint tax return filers with no dependents. Form 1040EZ has been eliminated with the new 2018 Form1040.

No 1040A in 2018

Nicknamed the “short form,” Form 1040A first appeared in the 1930s. It was restricted to use by taxpayers with taxable income below $100,000 who took standard deductions instead of itemizing deductions. 1040A has also been eliminated with the new 2018 Form1040.

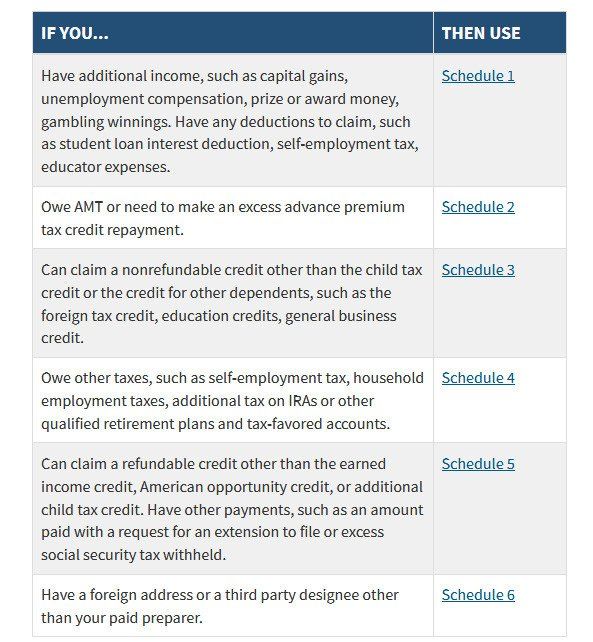

For 2018, all taxpayers will use the redesigned Form 1040, which now has six new numbered schedules in addition to the existing lettered schedules like Schedules A, B, C, D, E and F. The chart below listing the new schedules comes from the IRS.

One area we’ve found challenging to some of our clients over the years is providing the right documentation to substantiate sizable charitable contributions.

The IRS recently published final regulations clarifying several aspects of charitable gift reporting:

Donations of cash

For contributions of $250 to $500

To claim a cash contribution of $250 to $500, you must obtain a contemporaneous (originating at the time as the gift) written acknowledgement from the recipient of the donation.

For contributions of more than $500

To claim a monetary gift of $500 or more, you need either a bank record or a written communication with the recipient showing the name of the recipient, the date of the contribution, and the amount of the contribution.

Donations of property

To claim a donation of property valued under $250, you must receive a receipt from the recipient or keep “reliable records.” (We encourage getting a receipt.)

To claim non-cash contributions valued between $250 and $500, you’re required to obtain a contemporaneous written acknowledgment.

To claim a donation valued between $500 but less than $5,000, you must obtain a contemporaneous written acknowledgment from the recipient and file Form 8283 using Section A, Donated Property of $5,000 or Less and Publicly Traded Securities.

To claim a non-cash donation valued between $5,000 and $500,000, in addition to a contemporaneous written acknowledgment, you must obtain a qualified appraisal and file Form 8283 using Section B, Donated Property Over $5,000 (Except Publicly Traded Securities).

To claim a non-cash contribution of $500,000 or more, you must meet the requirements for a contribution of $5,000 to $500,000 and attach the qualified appraisal to your return.

What’s a "qualified appraisal?"

The IRS regulations define a "qualified appraiser" as an individual with "verifiable education and experience in valuing the relevant type of property for which the appraisal is performed" (Regs. Sec. 1.170A-17(b)(1)).

We get it. Your career demands are too hectic day-to-day for you to worry about the end of your fiscal year . . . until we get to the end of your fiscal year. And since most of our clients operate as small businesses, their fiscal year usually coincides with the calendar year.

That means you’re simultaneously faced with booking and using your talent, dealing with holiday hassles, and getting your paperwork in order so your accountant can prepare your tax returns (personal and business).

Here are a few year-end tax prep tasks every client can do right now to help assure a trouble-free tax preparation and filing experience for 2018.

Get organized

CPAs generally charge by the hour. That means, if you bring us all your receipts in a shoe box, for example, your tax return will be done, but it will take us longer to sort through everything that’s in the shoe box. Just as in your business, time is money.

It’s best if all your invoices and receipts are recorded in the same format in the same software program or spreadsheet.

Get reconciled

Bank reconciliation should be ongoing on a weekly basis throughout the year, but we realize it’s one of those things that gets back-burnered in the pressure and fast-pace of your professional life.

What we’re looking for is documentation of a bank transaction that corresponds with each entry in your accounting system.

Evaluate quarterly payments

If you make estimated tax payments quarterly, check to see how they correspond to the actual end-of-year numbers you achieved. The process will give you a good idea of the amount you’ll get back or how much you’ll owe this year.

And it will give your accountant benchmarks that will come in handy while preparing your tax return.

Review your W-9s

If you hire freelancers, you must issue 1099 forms to every person you paid at least $600 to for contract labor. If you didn’t anticipate paying him or her that threshold amount, you may have overlooked having them complete a W-9 form at the time. You can still have any missing W-9s completed before the end of the calendar year.

Call your CPA today

For a successful CPA practice, every day during tax season is like Black Friday to retailers. We’re deadline driven to get every tax return prepared as accurately and efficiently as possible.

The sooner we can sit down with our clients to review appropriate records and start preparing the return, the more likely this year’s tax filing project will be smooth and stress free.